237% Improvement in Total Return by Following Our Signals on SNAP

We are seeing some technology companies have big run-ups recently. Maybe it is time to ask if you should be doing something?

“Just do Something”

Snap, Inc., formerly Snapchat Inc., provides technology and social media services. The company develops mobile camera application products and services that allow users to send and receive photos, drawings, text, and videos. Snap serves customers worldwide. Bloomberg

SNAP was one of those companies that benefitted from the pandemic. On March 1, 2020, it traded at an interim low of $11.89 and by September 24, 2021, it traded at $83.11. On June 9, 2023, it closed at $10.13.

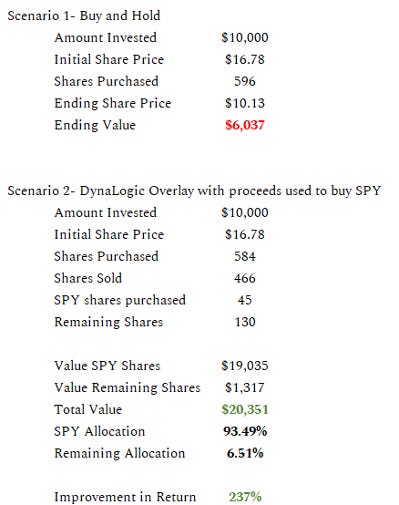

Let’s look at two scenarios: Scenario 1 is following a Buy and Hold strategy from 1/2/2020 to the present, and Scenario 2 follows DynaLogic’s sell signals and reinvests the proceeds in the S&P 500.

As the chart shows, there was a significant run-up in price after the March 2020 low, but after September 24, 2021, the stock has been in a free fall, down -88% from the August high!

Now let’s overlay the DynaLogic sell signals onto the graph. Sell signals are only generated as prices are moving higher and reach a predetermined sell price. While the recommended amounts to sell are typically small, they compound over time. This helps to produce a great result, as investors were able to cash in on some of SNAP’s gains and reduce their exposure before the drop, while also staying invested for the ride up!

Sell signals were primarily generated as the price of SNAP was rising, though some were generated while it was decline only when there was an uptick to a predetermined price from a previous buy price.

Now let’s examine the outcomes for each scenario:

The implementation of the sell signals and the reinvestment of the proceeds into the SPY ETF improved the overall return dramatically (by 237%!) and created significant diversification. An investor who put in $10,000 went from losing $4,000 to instead doubling their money!

Instead of continuing to own 100% SNAP in Scenario 1, the concentration in SNAP was reduced to 6.5% with 93.5% in SPY in Scenario 2. The initial investment in SNAP created a wonderful opportunity to capture significant price momentum and the reinvestment in the SPY ETF preserved the price appreciation. Remember that “Concentration creates wealth and diversification preserves wealth.”

This is just one of many case studies that underscores how following DynaLogic’s system can produce better outcomes in a variety of scenarios.

Right now, we are seeing big run-ups in stocks like Palantir and Nvidia, among others. Sure they could keep skyrocketing, but maybe it is time to learn from history and consider if you should be doing something. In fact, we have been sending sell signals on both of those names, among others in the past week. For full access to our signals, click below to claim a 30 day free trial!

“The predetermined buy and sell triggers built into the strategy make life easier and a more efficient use of time as it takes the emotion out of the equation.” T.S.

“I've been using DynaLogic for 6 months now. I've already seen a big impact and it's provided me a roadmap for sound decision making. The best part... I am not one that is trying to make the decisions. I've spent far too many years guessing what to do with my investments based on what feels right. This lays it all out in a simple way and tells me when and how to make decisions.” - Wes

“I've been following for awhile and just observing, I've missed out on major increases, while losing 20% trading on my emotions, I could've trippled that amount in gains if I followed your signals!

It's a no Brainer to sign up...I'm excited to see where this leads.

Now I can focus on increasing my income while following your trade signals” - Tim