Buying When Others Are Fearful

At the beginning of 2023, investor sentiment was clearly negative. Six months later, lots of managers had underperformed the markets. What did DynaLogic think?

As Warren Buffet would say, “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

The headlines of the Wall Street Journal (WSJ) for January 2, 2023, read “Investors Brace for More Market Tumult as Interest Rates Keep Rising”. Market Sentiment was negative.

Below are some clips from the WSJ article.

“Analysts at some of the biggest U.S. banks predict the stock market will retest its 2022 market lows in the first half of the new year before beginning to rebound. Many investors say the ramifications of the Federal Reserve’s higher rates are just beginning to ripple through markets.”

“The Federal Reserve has raised interest rates to the highest levels since 2007, stoking mammoth swings across global markets and a steep selloff in assets from stocks and bonds to cryptocurrencies. The tumult that erased more than $12 trillion in value from the U.S. stock market—the largest such drawdown since at least 2001—is expected to continue as rates keep rising.”

“The S&P 500 ended the year down 19% after the conditions evaporated that had paved the way for years of a nearly uninterrupted stock-market rally and a run in some of the most speculative bets. Analysts at Goldman Sachs expect the S&P 500 to end 2023 at 4000, about a 4% rise from where it ended 2022.”

“Investors yanked about $18 billion from mutual and exchange-traded funds tracking tech through November, on track for the biggest annual outflows on record in Morningstar Direct data going back to 1993. Funds tracking growth stocks recorded $94 billion in outflows, the most since 2016.”

“Meanwhile, investors have taken to bargain-hunting in the stock market, piling into value funds. Such funds recorded more than $30 billion of inflows, drawing money for the second consecutive year.”

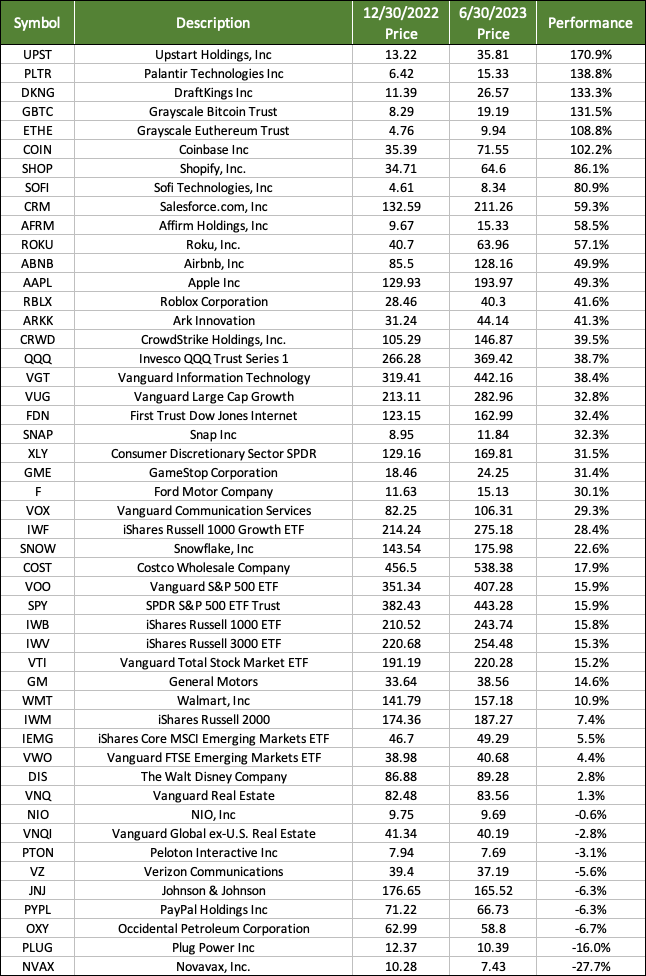

On January 2, 2023, DynaLogic posted on Substack in the “Next Buy and Sell” section 49 securities that had a 100% or Zone 4 Add/Initiate (Buy) rating as of December 30, 2022. As of June 30, 2023, the group of 49 was up collectively by 36.0%. Included in the list are 9 securities that were down for the year and 40 that were up, for a positive performance of 81.6%. The biggest loser was Novavax (NVAX), down -27.7% and Plug Power (PLUG), down -16%. The biggest winners were Upstart Holdings (UPST) up 170.9%, Palantir Technologies (PLTR) up 138.8%, DraftKings (DKNG) up 133.3%. Also included in the data is Apple (AAPL) which was up 49.3% and the S&P 500 ETF (SPY) which was up 15.9%. There were 28 securities or 57% that outperformed the S&P 500 over the 6-month timeframe. That’s a pretty impressive hit rate

With the introduction of our new Zone overlay, all these securities would be a Zone 4 Add/Initiate “Substantial Upside Opportunity”. Our zone system makes it easy to understand where a stock is in its journey and know when you need to act.

Most investors have heard that it pays to zig when the market zags; however, that can be hard to do when the financial experts are sounding the alarms. That’s why we created DynaLogic.

DynaLogic doesn’t listen to the experts and isn’t swayed by emotions. DynaLogic uses a mathematical algorithm to alert our subscribers to opportune moments to enter or add to a position, and when they need to consider trimming a position. In the long run, this system leads to better outcomes as any of our subscribers who acted on the Zone 4 Add/Initiate signals sent on Jan 2 can attest.

Ready to upgrade your subscription for full access to our daily signals on 170+ tracked securities? Click below to claim a 7 day trial of our full membership!

“DynaLogic doesn’t try to predict the future, DynaLogic prepares you for the future!”

Not convinced? Hear from some of our subscribers:

“The predetermined buy and sell triggers built into the strategy make life easier and a more efficient use of time as it takes the emotion out of the equation.” T.S.

“I've been using DynaLogic for 6 months now. I've already seen a big impact and it's provided me a roadmap for sound decision making. The best part... I am not one that is trying to make the decisions. I've spent far too many years guessing what to do with my investments based on what feels right. This lays it all out in a simple way and tells me when and how to make decisions.” - Wes

“I've been following for awhile and just observing, I've missed out on major increases, while losing 20% trading on my emotions, I could've tripled that amount in gains if I followed your signals!

It's a no Brainer to sign up...I'm excited to see where this leads.

Now I can focus on increasing my income while following your trade signals” - Tim

“I've been following DynaLogic for a while now, its an invaluable tool to use as part of my investing strategy. I find its difficult for me to sell stocks when they are rising, only to kick myself when I didn't take gains if it drops down the road. So many publications focus on telling you what stocks to buy but I haven't found anything like this that alerts you when to sell which is really helpful when you can't monitor all your stocks all the time. I've also had some really nice gains off the buy signals too.” - Kevin