Cracking Open Boston Beer: How DynaLogic's Signals Turned a Potential Loss into a 70% Gain

“Just do Something”- The Boston Beer Company

Let's delve into The Boston Beer Company (SAM). Founded in 1984 by James "Jim" Koch and Rhonda Kallman, this American brewery has made its mark with renowned brands like Samuel Adams, paying homage to the legendary Founding Father Samuel Adams himself. Over the years, Boston Beer has expanded its offerings, and in 2019, it joined forces with Dogfish Head Brewery, solidifying its position as the fourth-largest brewer in the United States, with a global presence.

From January 2, 2020, to April 20, 2021, SAM experienced an astounding surge, with the stock price skyrocketing from $371.12 to $1306.45. The introduction of Truly Hard Seltzer, an early player in the seltzer scene, played a pivotal role in this unprecedented growth. In October 2020 while the stock was on a rapid rise, one analyst said the stock was “priced for perfection”. Quarter after quarter earnings beat analysts’ earnings forecasts until July 22, 2021, when weaker Truly sales and overall industry softness resulted in earnings falling well short of analysts' expectations.

On July 22, 2021, the stock closed at $947.54. The next day the stock closed at $701 down a staggering 26%. On January 2, 2020, SAM closed at $371.12.

Sounds like a painful journey right? Well not if you were following DynaLogic’s signals.

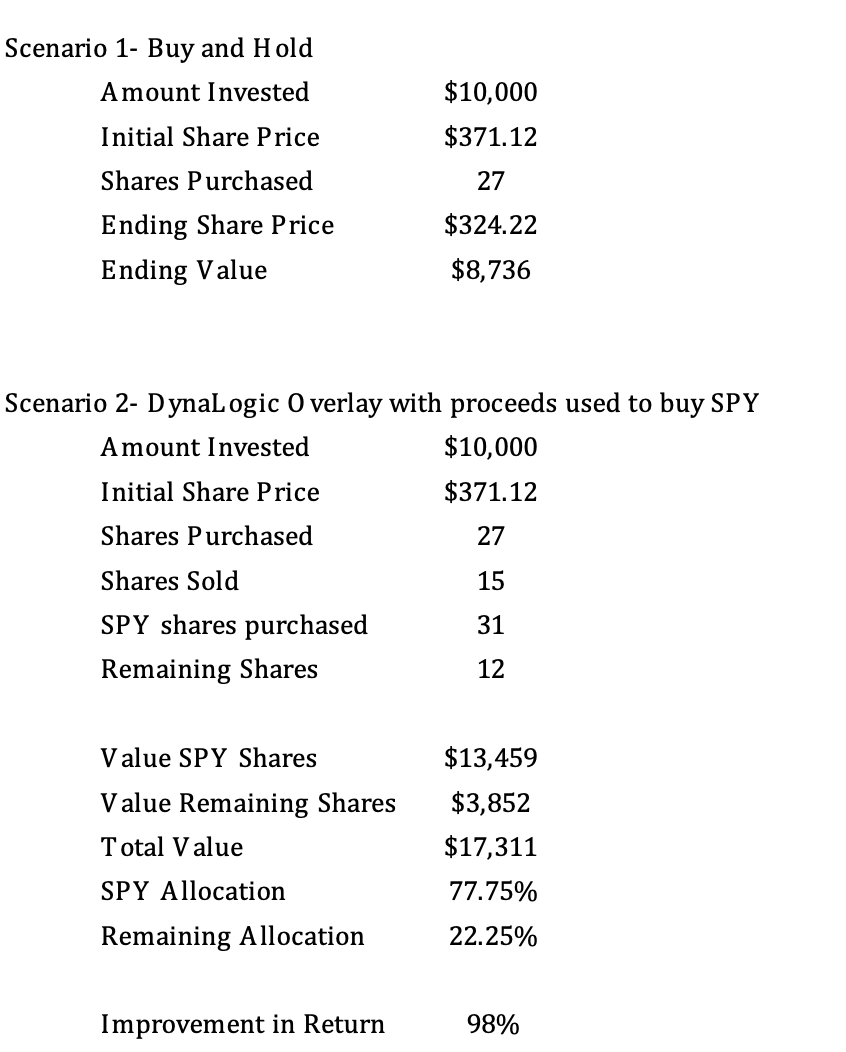

Let’s examine two scenarios from 1/2/2020 to 6/21/2023: Scenario 1-Buy and Hold, and Scenario 2 which uses the DynaLogic overlay sell strategy with proceeds reinvested in the S&P 500 ETF (SPY).

As the chart shows, there was a significant runup starting in April 2020 to April 2021 then the stock price collapsed, down 75%.

Now let’s overlay the DynaLogic sell signals onto the graph. These sell signals are generated as prices rise and reach predetermined sell points, allowing you to capitalize on profitable moments.

Let’s look at how an investment of $10,000 fared in each of the scenarios.

Implementing the DynaLogic sell signals and reinvesting the proceeds into the SPY ETF resulted in a striking 98% improvement in overall returns and significant diversification!

Scenario 2, unlike Scenario 1, reduced the concentration in SAM to just 22.25%, while allocating 77.75% to SPY. This approach harnessed the immense price momentum created by the initial investment in SAM, while preserving the gains through the strategic reinvestment in the SPY ETF.

Remember that "Concentration creates wealth, and diversification preserves wealth," this case study demonstrates the truth of that principle well.

DynaLogic doesn't attempt to predict the future, but rather prepares you for the future. Our comprehensive platform empowers you with daily add/initiate and sell signals, invaluable insights, and strategic guidance that pave the way for profitable investments. We're thrilled to offer you an exclusive opportunity to experience the benefits of DynaLogic with a 7 Day Free Trial.

Hear from some of our subscribers:

“The predetermined buy and sell triggers built into the strategy make life easier and a more efficient use of time as it takes the emotion out of the equation.” T.S.

“I've been using DynaLogic for 6 months now. I've already seen a big impact and it's provided me a roadmap for sound decision making. The best part... I am not one that is trying to make the decisions. I've spent far too many years guessing what to do with my investments based on what feels right. This lays it all out in a simple way and tells me when and how to make decisions.” - Wes

“I've been following for awhile and just observing, I've missed out on major increases, while losing 20% trading on my emotions, I could've tripled that amount in gains if I followed your signals!

It's a no Brainer to sign up...I'm excited to see where this leads.

Now I can focus on increasing my income while following your trade signals” - Tim

“I've been following DynaLogic for a while now, its an invaluable tool to use as part of my investing strategy. I find its difficult for me to sell stocks when they are rising, only to kick myself when I didn't take gains if it drops down the road. So many publications focus on telling you what stocks to buy but I haven't found anything like this that alerts you when to sell which is really helpful when you can't monitor all your stocks all the time. I've also had some really nice gains off the buy signals too.” - Kevin