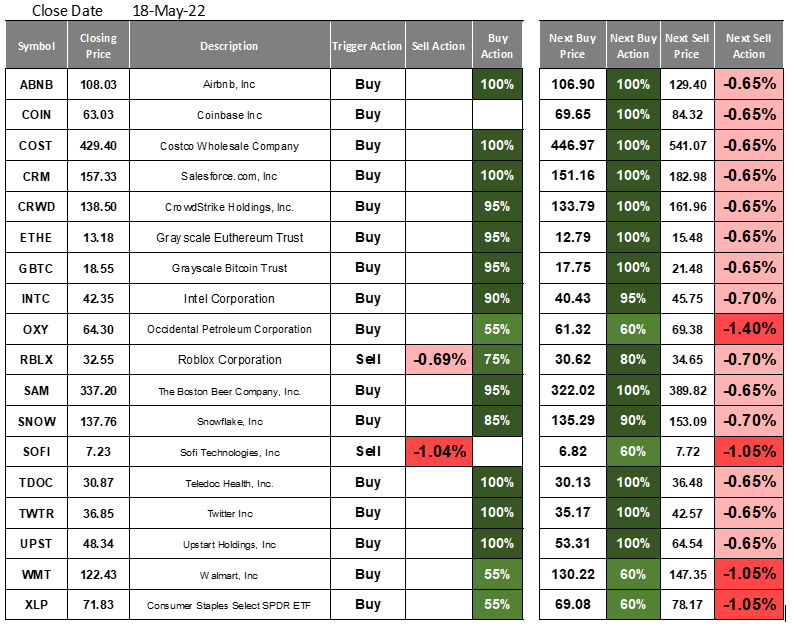

All Buy and Sell actions are based on a mathematical percentage (%) change in price from the prior market close.

If you’re a new subscriber, to read about the Logic behind DynaLogic, click HERE.

Sell Action- Indicates the % sale (% of shares) of an underlying security to be sold based on the signal technology. During extreme market volatility, it is very possible the closing price of a security is above the Next Sell Price as the Next Sell Price is established at the time of the last sell price.

Buy Action- Indicates the % of available cash set aside that could be committed to the underlying security. Let’s assume you have cash set aside to invest in AMZN and the Buy Action says 35% then 35% of the available cash allocated for AMZN should be invested based on the signal technology. During extreme market volatility, it is very possible the closing price of a security is below the Next Buy Price as the Next Buy Price is established at the time of the last buy price.

For a full list of the securities we are tracking, which include individual securities, cryptocurrency, ETFs and more, refer to our Signal Offerings Reference sheet found here. For more information on how to use our daily price signals and the logic behind DynaLogic, see the post here.

DynaLogic-Where Logic and Technology Merge

(Note: DynaLogic provides to subscribers relevant and real time market movement information on a host of equity securities. Signals (sell or buy) are based solely on mathematical changes in the price of a security. No other methodology is used.

DynaLogic is not a registered investment advisor, and it makes no representation or recommendation concerning the purchase or sale of any security investment product; DynaLogic provides no advice or recommendation whether a subscriber should or should not act on any signal a subscriber receives, and it has no knowledge whether a subscriber, in fact, acts on a signal or any signal; DynaLogic maintains no portfolio account or other investment information on any subscriber.)