Good-Till-Cancelled-GTC

We are barely 2 months into our “Risk Off” launch which officially started on June 4th, and we are closing in on 800 subscriptions which has exceeded our wildest dreams. We are extremely grateful have you as a subscriber. We will continue striving to provide beneficial content and we will be with you every step along your investment journey.

We have always strived to deliver content that can help each of you on your investment journey. While many of you are opening the daily “Risk Off” post, others are checking in periodically so we wanted to share with you a trade function that we believe might be beneficial to all. While we have no way of knowing where you hold your custody account, the GTC-Good-Till-Cancel order is available universally. Because “Risk Off” publishes daily the next Buy and Sell signals, you can use the daily information to enter a Buy or Sell order, base the size of your order using the posted information or enter your own size order, and assign a price limit to the order.

You don’t need to wait for the daily post to see if one of your securities reached a trigger price.

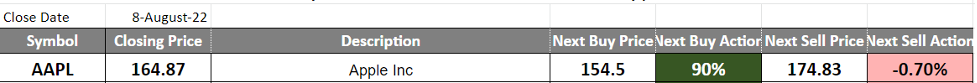

In the example above, AAPL has a Buy price of $154.50. You can enter a GTC Limit order to invest 90% of cash available for AAPL. Let’s say you had $1000 available to invest in AAPL, Then 90% 0f $1000 or $900 at $154.50 equals 5.82 shares. Some custodial platforms let you buy fractional shares otherwise round up or round down. You would enter a GTC Limit Order to Buy 5.82 shares at $154.50. When AAPL reaches $154.50, the Limit Order becomes a Market Order, and you will get the market price which will be at or near $154.50 for 5.82 shares. When AAPL reaches $154.50, the Buy price will be updated, and you can enter a new GTC order if you still have cash allocated for AAPL. If you already own AAPL, enter a GTC Limit order to Sell .7% of your position at $174.83. Obviously, you can sell any amount you choose, but “Risk Off” is just telling you at a minimum, “Just do Something”. One of the benefits of a GTC order is its not waiting for end-of-day pricing, once the security trades at your limit price during the day, it becomes a market order, and you will be notified that the order was filled.

On August 2nd we published a Substack post titled “Just do Something – A Market Low” in which we identified 17 Symbols that on that June 16 had a Buy, and the Buy amount was 100%. On July 29th, the collective gain across all 17 securities was 9.24% after paying short term capital gains tax of 40%. A GTC Limit Sell order at the time of the purchase probably would have worked out well.

One of the primary goals in investing is to remain unemotional. A GTC Limit order to Sell or Buy can be a smart way to take the emotion out of the equation.

As Warren Buffett likes to say, “Buy when others are selling, and sell when others are buying”.

We hope you will encourage your friends to become a subscriber- please share our Posts.

Thank you!

(Note: DynaLogic provides to subscribers relevant and real time market movement information on a host of equity securities. Signals (sell or buy) are based solely on mathematical changes in the price of a security. No other methodology is used.

DynaLogic is not a registered investment advisor, and it makes no representation or recommendation concerning the purchase or sale of any security investment product; DynaLogic provides no advice or recommendation whether a subscriber should or should not act on any signal a subscriber receives, and it has no knowledge whether a subscriber, in fact, acts on a signal or any signal; DynaLogic maintains no portfolio account or other investment information on any subscriber.)