Turn Options Trading Into Profit! DynaLogic Identifies Trades Using Rules-Based Guidelines. No Complex Trades Required. Simple Long Only Puts & Calls

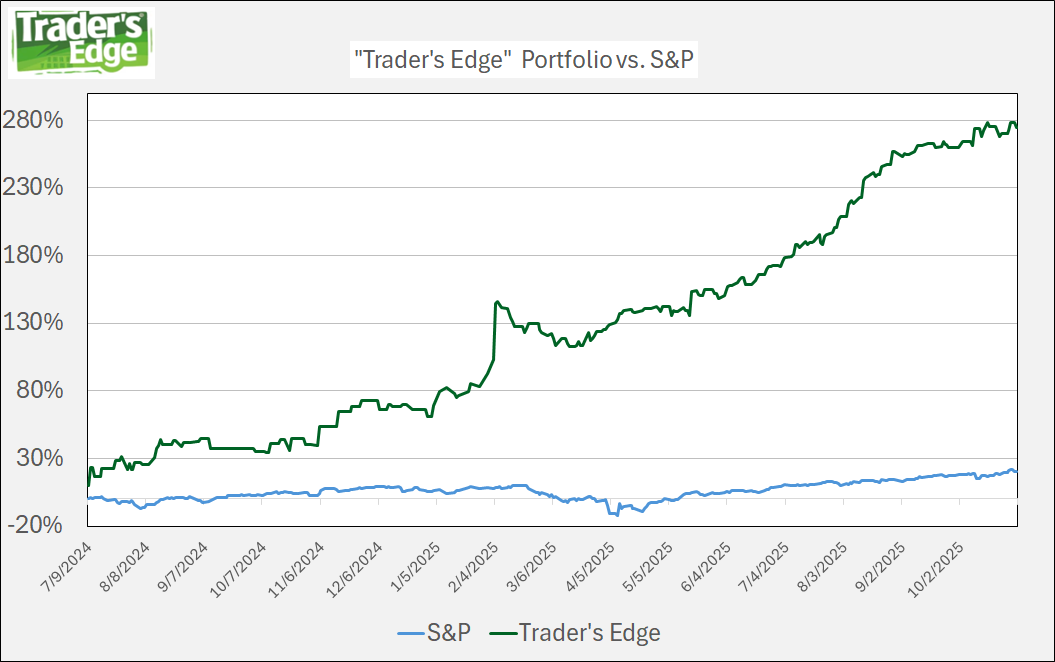

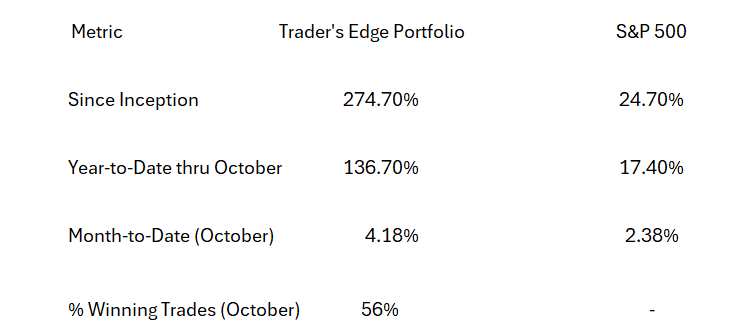

Since its launch in July 2024, Trader's Edge has delivered a remarkable 274.7% return (as of the end of October, 2025), dramatically outpacing the S&P 500's 17.4% gain.

Most investors struggle with options trading in large part because of a lack of a disciplined risk control process, whereas our subscribers are systematically profiting from market volatility in both directions, by capturing winners and managing losses with established risk limits. Since July 2024, as of 10/31/25, our options trading portfolio has delivered a remarkable 274.7% return, dramatically outpacing the S&P 500's 17.4% gain.

Proven Results, Not Just Promises

Our data-driven system identifies high-probability options trades, whether puts or calls, based on specific market conditions and momentum. Here are some examples from our track record:

TMDX Call: +141.8% gain in just one day

Tesla (TSLA) Call: +115% return on a one-day trade

Palantir (PLTR) Call: +102% gain in 24 hours

Goldman Sachs (GS) Put: Two consecutive winning trades of 17.1% and 30.9%

Cheniere Energy (LNL) Put: +42.5% in two days

Applied Materials (AMAT): +38.4% in two days.

Palantir (PLTR) Call: 341% in two days

Micron Technology (MU) 30.8% return o a one-day trade

UnitedHealth (UNH) 35.8% return in 2 days

United Health (UNH) 57.4% return in 2 days

Affirm (AFRM) 38.4% return on a one-day trade

CRISPR (CRSP) 19.1% return on a one-day trade

Advanced Micro Devices (AMD) 23.1% return on a one-day trade

IBM- 22.5% return on one-day trade

AVGO- 18.1% return on one day trade

United Parcel Service (UPS) 33.4% return in one-day trade

Coinbase (COIN) 30.2% return in one-day trade

AppLovin (APP) 26.4% return in one-day trade

Newmont (NEM) 27.6% return in two day trade

But we're not just highlighting some of winners. Our approach is about consistent, disciplined trading. With an average trade size around $250-$300, we've grown our live demonstration Schwab account from $1,000 to just over $3747 in just over 15 months. This includes both winning and losing trades - in fact, we're sharing our trade history (Schwab account) for October at the bottom of this post. Of course, we wanted to keep our trade sizes small to demonstrate that “Trader’s Edge” works for accounts of any size.

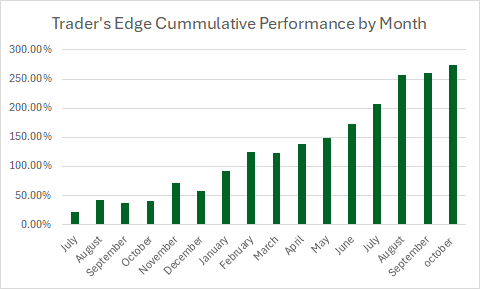

What matters isn't individual trades but our systematic, rules-based approach to finding opportunities and managing risk. Our strategy has delivered steady growth through different market conditions:

July '24: +21.7% cumulative end-of-month performance

August: +42.1% cumulative end-of-month performance

September: +37% cumulative end-of-month performance

October: +40.6% cumulative end-of-month performance

November: +71.5% cumulative end-of-month performance

January ‘25: +92.5% cumulative end-of-month performance

February +125.5% cumulative end-of-month performance

March +123.6% cumulative end-of-month performance

April +139.3% cumulative end of month performance

May +148% cumulative end-of-month performance

June +172.6 cumulative end of month performance

July +206.4 cumulative end-of-month performance

August +256.7 cumulative end-of-month performance

September +259.7 cumulative end-of-month performance

October + 274.7 cumulative end-of-month performance

Ready to start testing Trader's Edge for yourself? Claim a free month, exclusively for new subscribers.

From Our Subscribers:

⭐⭐⭐⭐⭐

“Trader's Edge has completely transformed how I approach options trading. Before, I felt like I was always guessing, chasing trends, and struggling with emotional decisions. But with their data-driven signals and clear guidance, I now trade with confidence and consistency.” - Kevin F.

⭐⭐⭐⭐⭐

“Since joining, I’ve seen steady portfolio growth, and what’s most impressive is their risk management—winning trades are celebrated, but losses are kept small and manageable. Their momentum-driven strategies are simple to follow, and the transparency of their track record speaks volumes.

If you’re serious about options trading or just looking to enhance your portfolio’s performance, Trader's Edge is an absolute game-changer. I wish I’d found it sooner." - Shelby D.

⭐⭐⭐⭐⭐

“I have been a partner with “Trader’s Edge” since July and the results speak for themselves. Before using Trader’s Edge, my consistency was way down, some months I would make a decent percentage, other months I would give it all back. I could never seem to make true progress. Since joining, I have not had a single month where I did not make at least 5% increase. Sure, a few red trades here and there…but my win rate has increased and my consistency has vastly improved. The service literally paid for itself 10x over in the first month! If you are struggling to find your feet as a trader and would like to have consistency and success in your routine, join Trader’s Edge immediately! “ Luke F.

The Trader's Edge Advantage:

Data-Driven Signals: Our proprietary DynaLogic system combines Zone technology with RSI readings to identify optimal options trading opportunities

Accessible Options Trading: Average trade size of just $250-300, making options trading feasible for accounts of any size

Clear Risk Management: Defined exit points (Limits) and position sizing to protect capital when trading options

Systematic Approach: Remove emotion from your options trading with our rules-based system

Tracking a broad range of securities with high Betas.

🧾 How Risk Management Shows Up in Trader’s Edge

Since launching Trader’s Edge on July 9, 2024, we’ve used consistent position sizing and stop-based risk rules to guide every trade. The results speak for themselves—even though nearly half our trades are losers, our portfolio has more than doubled.

Here’s how our real-money portfolio at Schwab stacks up as of October 31:

Even with 44% of all trades being losing trades, our risk management process protected our capital and let our winners shine.

How it Works

Our system identifies opportunities through multiple key indicators:

DynaLogic Zones (1-4): Indicating potential risk/reward scenarios

Relative Strength Index (RSI): Identifying overbought/oversold conditions

The examination of 200DAY, 50DAY, and 14Day Exponential Moving Averages

When these align with our proven criteria, we alert subscribers to potential trades.

New to Options? Check Out Our Comprehensive Trading Guide

What Premium Members Receive

Daily options trade recommendations

Complete signal data on 370+ securities

Current Zone and RSI readings

Risk management guidelines

Access to our historical trade database

Options trading educational resources

Limited Time Offer

Start your free trial today and get:

30 days of full premium access

Historical trade database

Risk-free trial - cancel anytime

Don't let market volatility intimidate you - learn to profit from it. Join Trader's Edge today and start trading with confidence

.

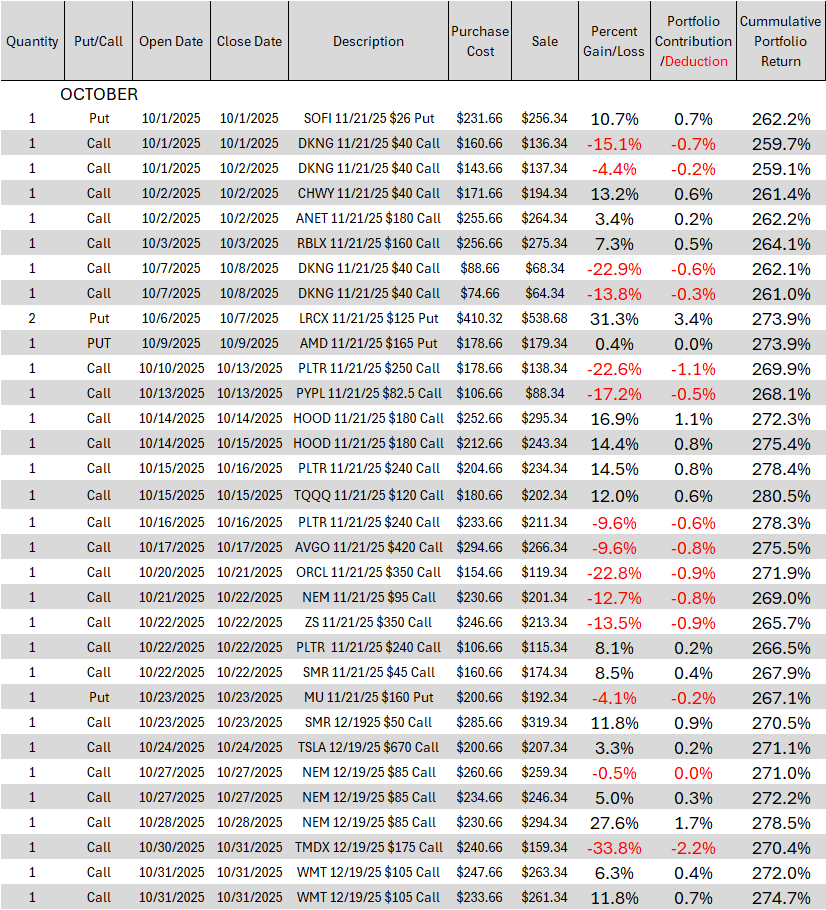

Trader’s Edge Results for the Month of October

Trades shown in yellow are trades that are still OPEN

Overall Performance:

Starting balance: $1,000 (July 9, 2024)

Current value: $3747 as of October 31st

Trade Statistics:

Mix of puts and calls

Average trade size: ~$250-$300

Typical hold time: 1-2 days

Most losing trades limited to -1% to -3% of the value of the portfolio

Notable wins: PLTR call (102%), TSLA call (115%), TMDX call (139.8%)

Risk Management:

Losses typically limited to 1-3 percent of the value of the portfolio

Multiple partial position entries/exits

Mix of short-term and slightly longer-dated options

This data shows a systematic approach with:

Consistent trade sizing

Defined risk parameters

Ability to profit in both up and down markets

Strong overall risk-adjusted returns