Welcome to the "Investor's Compass" for 12/24/24

Stay on top of the market with our rules-based strategies to help manage both upside and downside momentum.

🔥 Trader's Edge Spotlight 🔥

Since launching in July, Trader's Edge has delivered a 64.2% portfolio return, versus the S&P 500's 7.0% gain. While not every trade is a winner, our risk management controls and our data-driven approach continues to identify high-probability opportunities in both rising and falling markets. If you missed it, check out this recent article on why you need to have Trader’s Edge as part of your investing toolbox.

Want access to all our options trade recommendations including the call options we are monitoring today, PLUS our complete securities tracking list with current Zone and RSI readings?

Upgrade to premium today and don't miss our next potential winner!

*Past performance does not guarantee future results. Options trading involves risk.

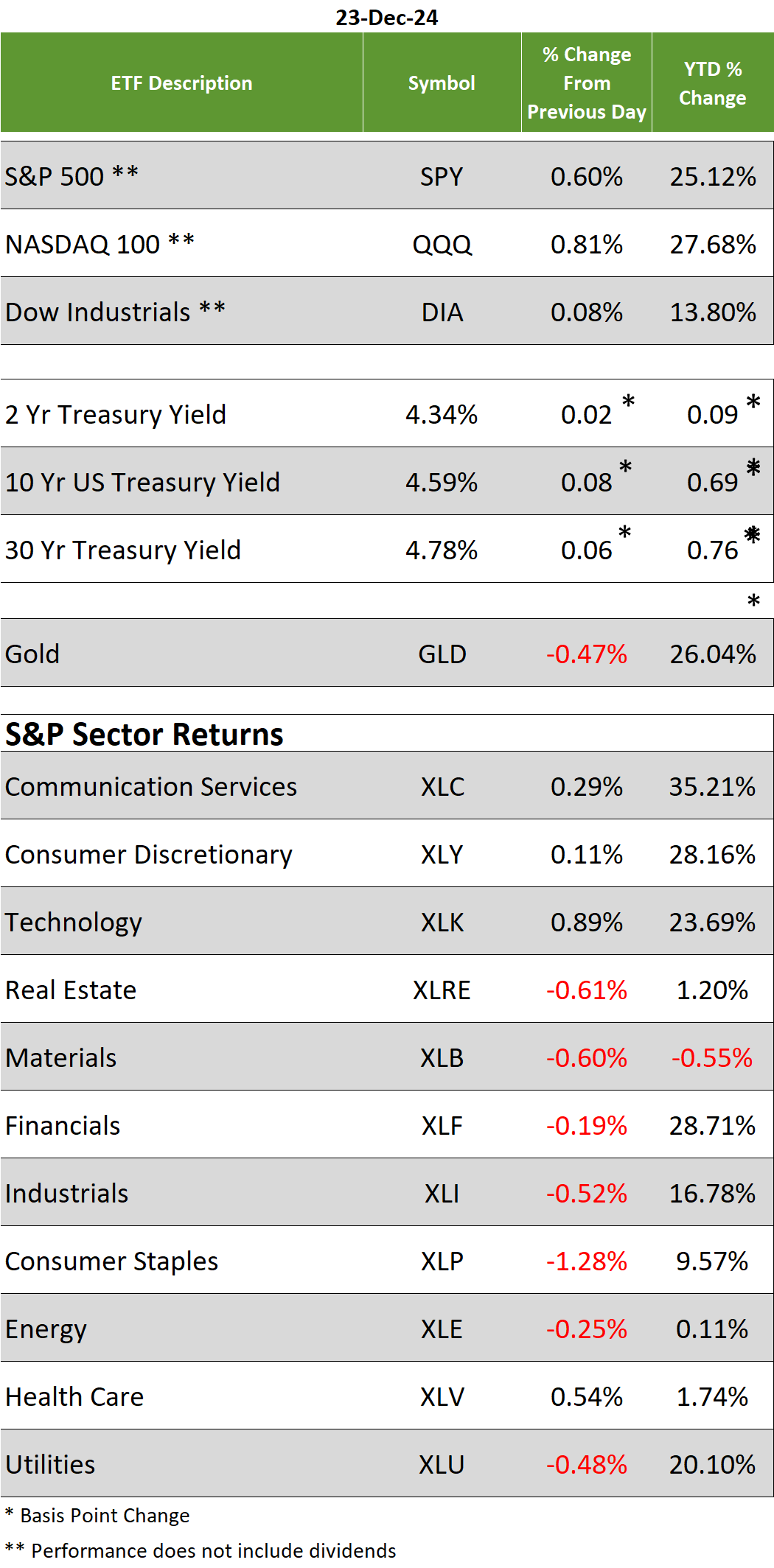

Today’s Market Roundup

Broad markets finished on the plus side with the Dow up .08%, the S&P up .60%, and the Nasdaq up .81%. Treasury yields were higher on the longer end of the yield curve and gold was down -.47%. S&P sectors were mixed with Technology leading on the upside up .89%, followed by Health Care up .54%. Consumer Staples was the big loser off -1.28%, followed by Real Estate off -.61%.

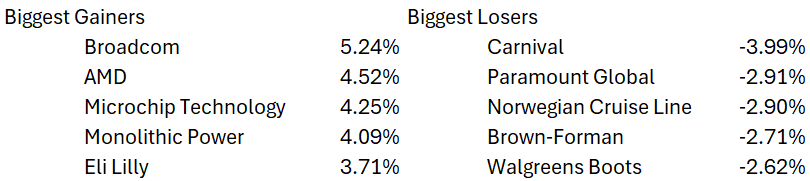

S&P Biggest Gainers & Losers

Economic Calendar

Tuesday- Durable goods, New home sales

Wednesday- Christmas holiday

Thursday- Initial jobless claims

Friday- Advanced U.S. trade balance, Advanced retail inventories, Advanced wholesale inventories

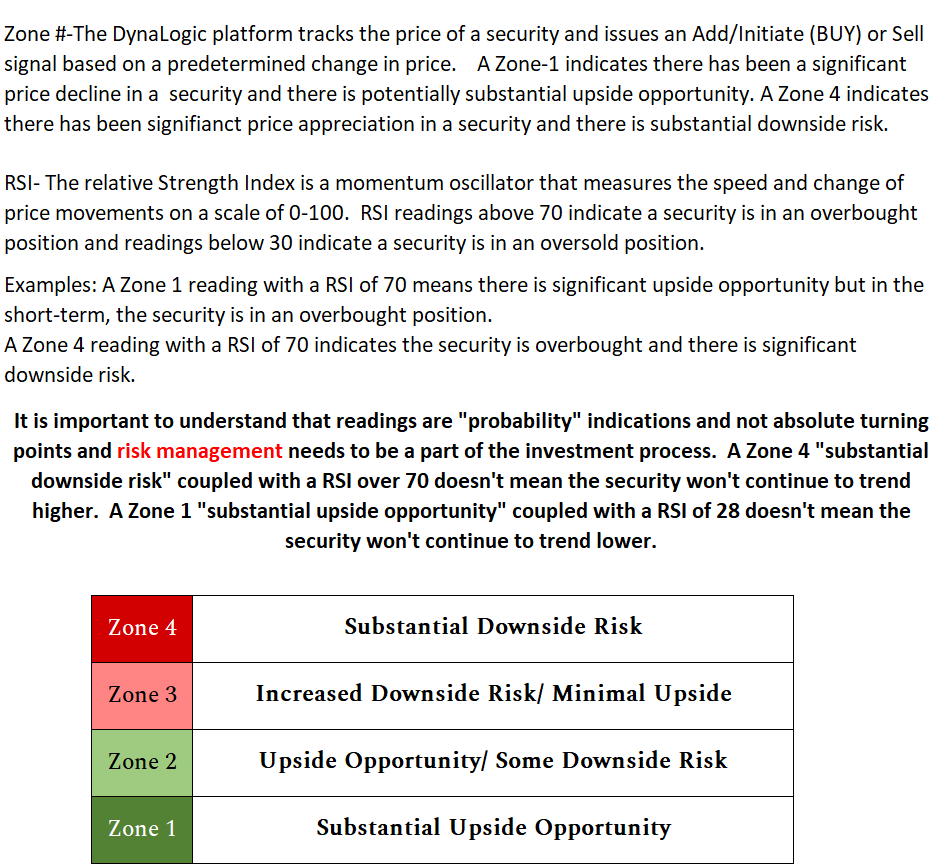

📊 DynaLogic Daily Signals: Your Guide to Strategic Rebalancing

Our proprietary DynaLogic system continues to monitor over 350 securities, providing daily signals to help you strategically rebalance your portfolio. These signals offer insights into:

Buy/Sell recommendations based on price movements

Current DynaLogic Zone (1-4) indicating potential risk or opportunity

Relative Strength Index (RSI) showing overbought or oversold conditions

Whether you're looking to take profits, add to your positions, or initiate new ones, these signals can help you make informed decisions for long-term portfolio management. We have decided to make these signals available to our free subscribers, although the full data sheet with current zone, and RSI reading will only be available to premium subscribers.

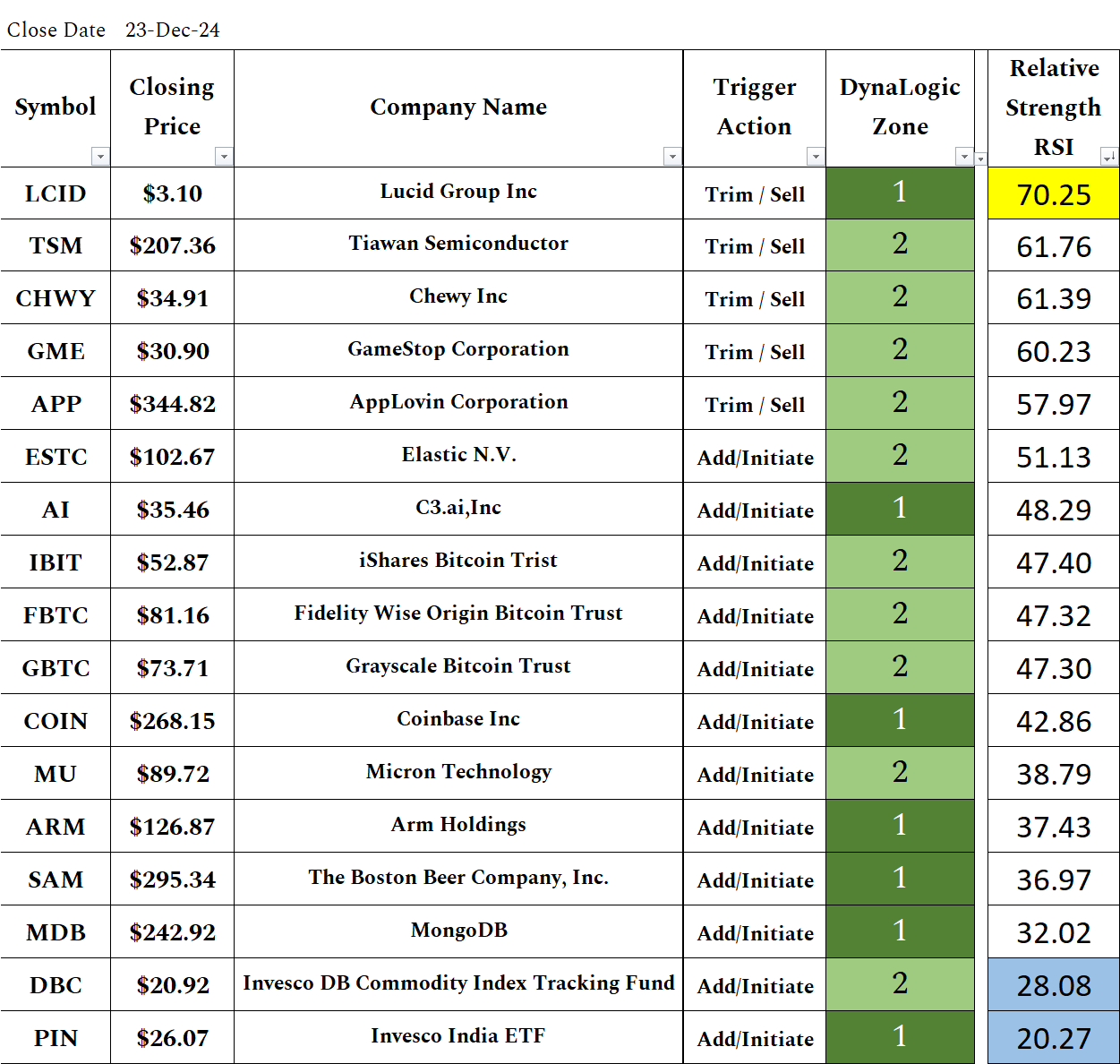

Today’s Signals Powered by DynaLogic

For a full list of the 350+ securities we are tracking, which include individual securities, cryptocurrency, Index and Sector ETFs and more, refer to our Security offering sheet.

Remember: The signals above are designed for adding new positions to your portfolio or strategic rebalancing of your existing holdings. For short-term trading opportunities, check out our Trader's Edge recommendations, available to paid subscribers only.

What is Trader’s Edge?

Trader's Edge identifies high probability put and call options trades based on specific criteria, such as securities in DynaLogic Zone 1 or with significantly overbought or oversold RSI readings. For more on how Trader’s Edge works and how to use it, please see this post.

Question: Why was Trader’s Edge created?

Individual securities, while having some correlation to the broader markets, can carry a much higher volatility. Using Puts to capture downside volatility and Calls to capture upside volatility can enhance the overall return of a portfolio.

How to Use Trader's Edge Signals

Trader's Edge signals are designed to help subscribers make informed short-term options trades. However, it's crucial to understand options trading and practice proper risk management before acting on these signals. Always use stop losses to limit your downside risk and never invest more than you can afford to lose.

Want to see the specific tickers and option strategies? Upgrade to our premium subscription now to access today's full Trader's Edge recommendations and the complete list of all our detailed signal data! Don’t miss the next trade!

Trader’s Edge portfolio

Since July 9, when Trader’s Edge was launched, the portfolio is now up 64.2% as of 12/23 vs. S&P 7.0%.