Welcome to "The Investor's Compass" Powered by DynaLogic for 6/16/25

Stay on top of the market with our rules-based tracking system designed to help manage both upside and downside momentum.

Today’s Market Roundup

Broad market ETFs finished down on the day with the Dow off -1.78%, the S&P off -1.12%, and the Nasdaq off -1.26%. Treasury yields were higher across the curve and gold was up 1.31%. S&P sectors were mostly down led by Financials off -2.04%, followed by Technology off -1.40%. Energy was the sole winner up 1.74%.

S&P 500 Gainers and Losers

Economic Calendar

Monday- Empire State manufacturing survey

Tuesday- U.S. retail sales, Import price index, Industrial production, Capacity utilization, Business inventories, Home builder confidence index

Wednesday- Housing starts, Building permits, Initial jobless claims, FOMC interest rate decision, Fed Chair Powell press conference

Thursday- None scheduled

Friday- Philadelphia Fed manufacturing survey, U.S. leading economic indicators

📊 DynaLogic Daily Signals: Your Guide to Strategic Rebalancing

Our proprietary DynaLogic system continues to monitor over 350 securities, providing daily signals to help you strategically rebalance your portfolio. These signals offer insights into:

Buy/Sell recommendations based on price movements

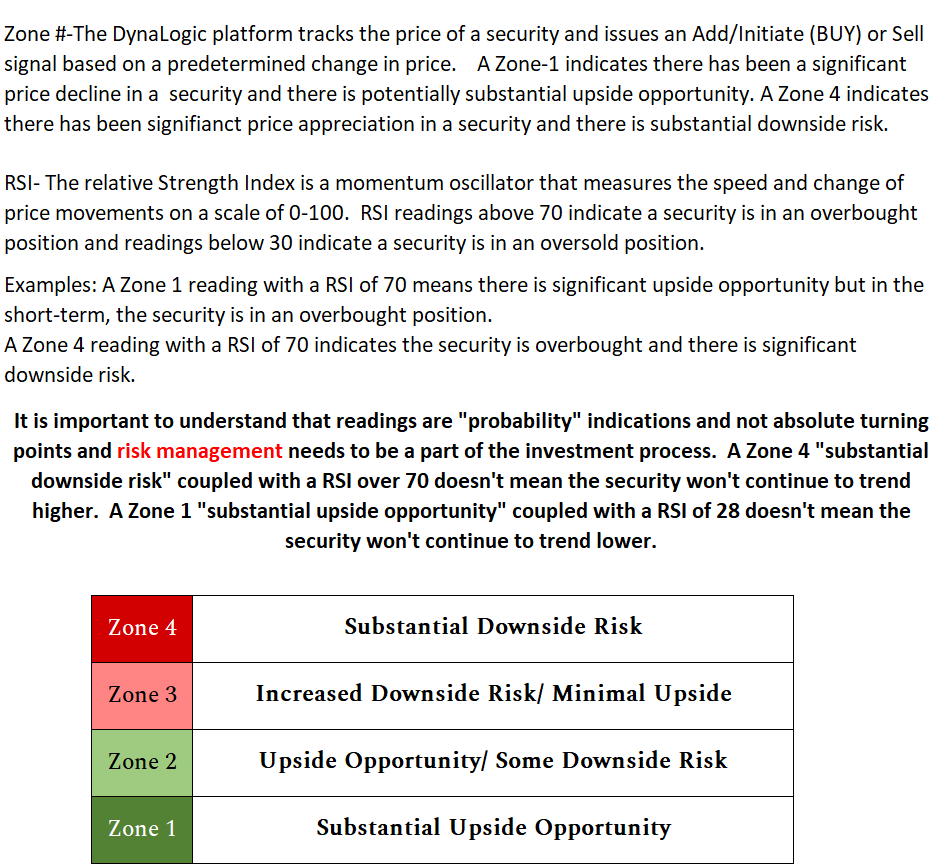

Current DynaLogic Zone (1-4) indicating potential risk or opportunity

Relative Strength Index (RSI) showing overbought or oversold conditions

Whether you're looking to take profits, add to your positions, or initiate new ones, these signals can help you make informed decisions for long-term portfolio management. We have decided to make these signals available to our free subscribers, although the full data sheet with current zone, and RSI reading will only be available to premium subscribers.

Today’s Signals Powered by DynaLogic

Please CLICK HERE for a complete list of updated Zones and RSI on our entire list of 350+ securities and ETFs

For a full list of the 375+ securities we are tracking, which include individual securities, cryptocurrency, Index and Sector ETFs and more, refer to our Security offering sheet.

Remember: The signals above are designed for adding new positions to your portfolio or strategic rebalancing of your existing holdings. For short-term trading opportunities, check out our Trader's Edge recommendations, available to paid subscribers only.

Looking for an opportunity to enhance portfolio returns we invite you to test drive Trader’s Edge with a 30 day Free Trial.

What is Trader’s Edge?

Trader's Edge is a fully transparent, data-driven options trading system that provides high-probability put and call trade ideas.

Unlike traditional financial publications that only highlight their biggest winners, we share every trade—win or loss—so you get the full picture. Our system is designed to identify opportunities based on DynaLogic Zone 1 signals and overbought/oversold RSI readings, helping traders take advantage of short-term market momentum.

📈 Why Was Trader’s Edge Created?

Individual stocks can be far more volatile than the overall market—creating both risks and opportunities.

We designed Trader’s Edge to help traders systematically capitalize on this volatility through a rules-based approach that:

✅ Uses Calls to capture upside momentum

✅ Uses Puts to profit from downside movement

✅ Applies strict risk management to avoid large drawdowns

By following our fully transparent, disciplined system, traders can enhance their portfolio performance without emotional decision-making.

How to Use Trader's Edge Signals

🔹 Clear, Simple Trade Ideas – Our signals highlight high-probability setups based on momentum, DynaLogic Zones, and RSI readings.

🔹 Risk Management First – We always recommend using stop losses and only trading what you can afford to risk.

🔹 No Complex Strategies – We focus on long-only puts and calls, making it accessible to traders of all levels.

Want to see our specific tickers and option strategies for today?

🔓 Upgrade to Trader’s Edge now to unlock the full list of today’s trades and get real-time signals.

📊 Full Trade History Available: No Cherry-Picking

📈 Since July 9, 2024 launch:

✔ Trader’s Edge Portfolio: +158.6%

✔ S&P 500: 7.4%

✔ All trades recorded—wins AND losses.

📢 Want to see every trade for yourself? Get full access to our real-time signals & trade history with a 30-day free trial.

🚀 Join the other traders who rely on transparency, not hype. Upgrade today.

"Trader's Edge has completely transformed how I approach options trading. Before, I felt like I was always guessing, chasing trends, and struggling with emotional decisions. But with their data-driven signals and clear guidance, I now trade with confidence and consistency." - Kevin F.