Using DynaLogic Led to a 83% improvement in Total Return for Owners of Alibaba Stock Who Followed Our Signals

In our latest edition of "Just Do Something", we explore a case study on Alibaba and how following DynaLogic's sell signals dramatically improved return for our subscribers.

Alibaba Group Holding Limited (BABA) is China’s- and by some measures, the world’s biggest online commerce company. It’s three main sites, Taobao, Tmall, and Alibaba.com have hundreds of millions of users, and host millions of merchants and businesses. Alibaba handles more business than any other e-commerce company. WSJ

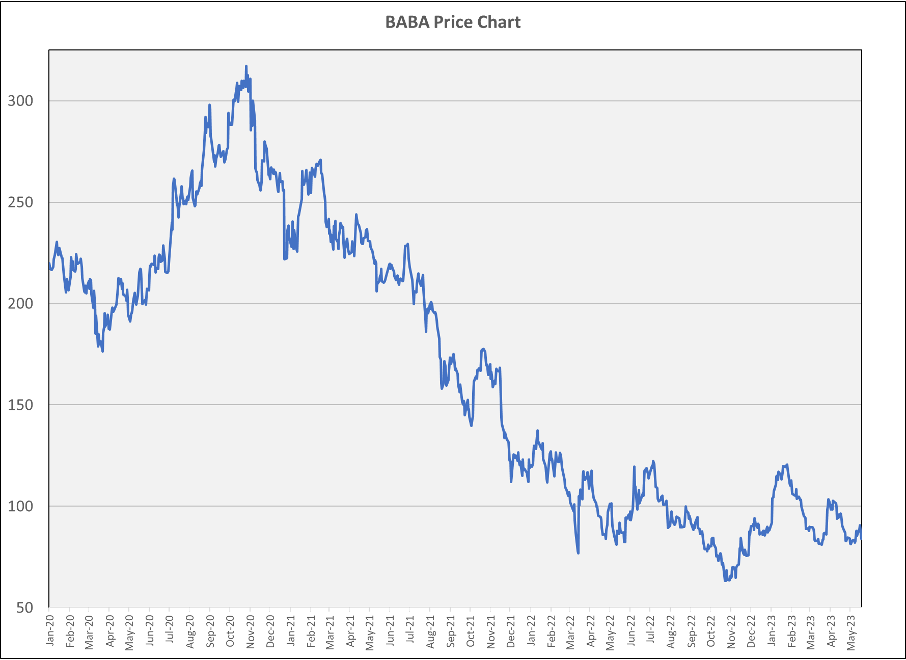

Over the last couple of years, we have seen Alibaba’s stock increase substantially in value, especially during the e-commerce surge driven by COVID, only to come crashing back down.

BABA is one of the securities tracked by DynaLogic.

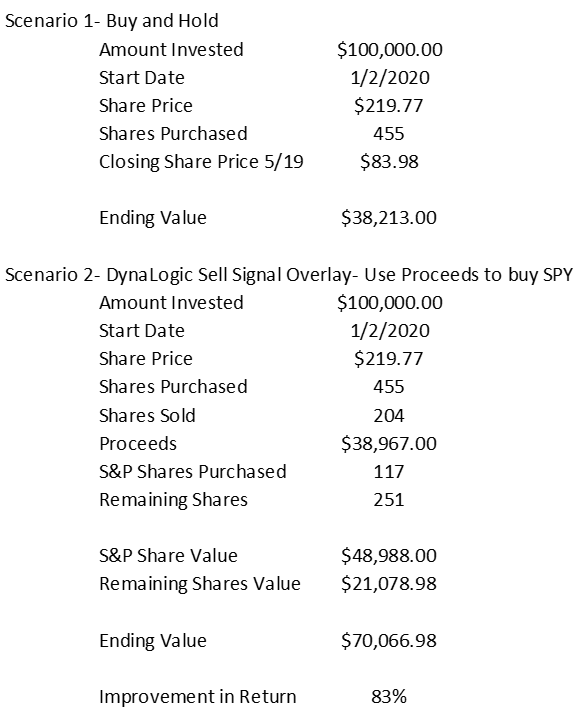

Let’s examine an investment in BABA on 1/2/2020, before the pandemic, and look at two scenarios. In Scenario 1, you simply Buy and Hold while in Scenario 2, you follow the DynaLogic sell signals and invest the proceeds after tax in the S&P 500 ETF (SPY).

Below is a chart of Alibaba’s price movement during this period.

Now, let’s overlay the DynaLogic Sell signals onto the graph. Remember, Sell signals are generated as prices are moving higher and reach a predetermined sell price. Sell signals were generated while the price of BABA was declining when there was an uptick from a buy price that reached a predetermined price according to the DynaLogic algorithm.

As the chart shows, there was a significant runup in price during the early stages of the pandemic but since October 2020, the stock has trended lower. Now let’s look at our 2 scenarios and see what the outcomes were.

Following DynaLogic’s sell signals and then reinvesting into the SPY improved the return dramatically and created significant diversification. Instead of still owning 100% BABA, the concentration in BABA was reduced to 30% with 70% in SPY while total return improved by 83%. While DynaLogic’s sell signals can be of smaller sizes, following them can lead to a dramatically improved result.

While we certainly all prefer scenarios where DynaLogic helps you make money (and we have plenty of those), avoiding losing money is just as valuable, if not more so. As Warren Buffett has said, “The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

In this case, DynaLogic helped reduce what could have been a brutal loss of capital for BABA investors. There are two factors that are frequent pitfalls for many DIY investors, not effectively managing emotions and not actively monitoring their portfolios. DynaLogic helps with both, by telling you WHEN to act and WHAT to do.

Its easy to do nothing and assume (or at least hope) that Alibaba’s rapid rise during COVID would continue forever. Its much harder to take some off those gains off the table as its happening. DynaLogic helps you do so in a mathematical and logical way, leading to better investing results in many scenarios. It also helps you find opportune moments to buy back into stocks you believe in at a lower price.

If you’re ready to start investing smarter with DynaLogic, sign up for a 30 day free trial with the link below.