Case Studies

🔥 Spotlight: Trader's Edge Performance Update

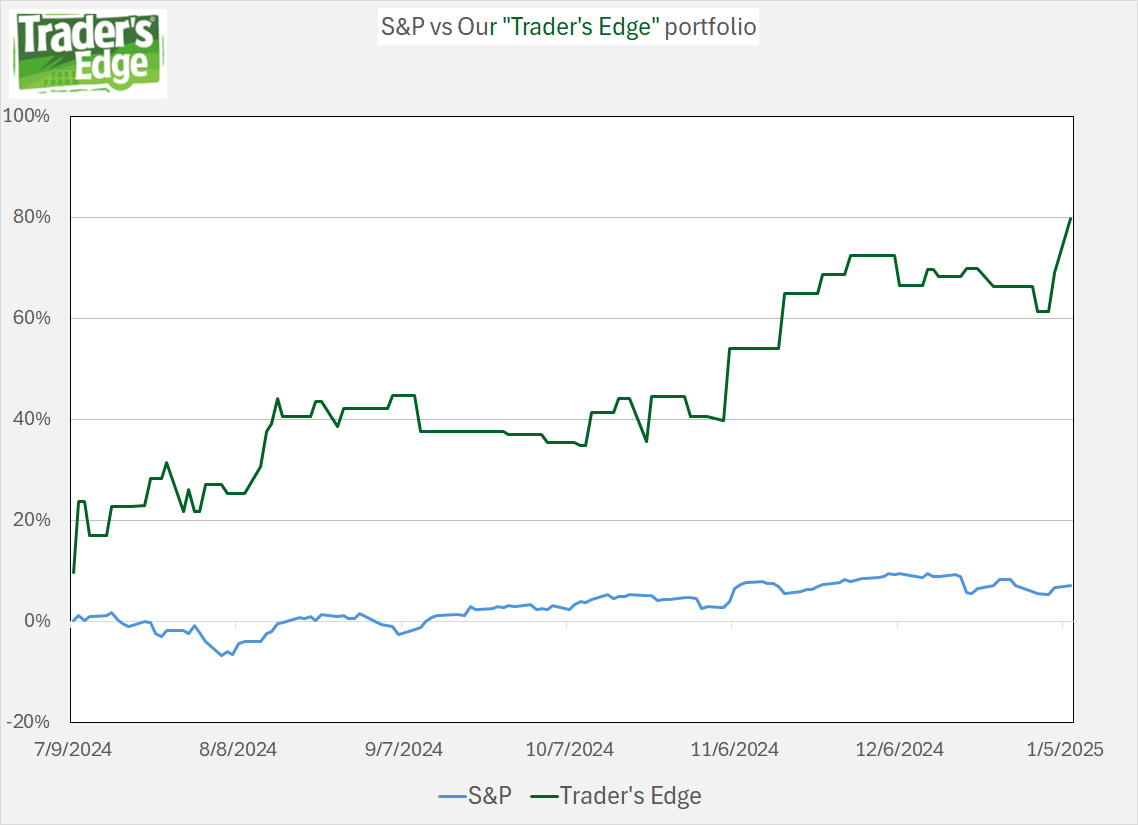

Want to see systematic options trading in action? Since July 2024, we've been running a live demonstration account starting with just $1,000. Using our proprietary DynaLogic system and strict risk management protocols, we've grown this account to over $1,788 (+78.8%) while the S&P 500 gained just 6.1%.

Notable trades include:

A 141.8% single-day gain on TMDX

Multiple 100%+ winners on major tech names

Consistent performance through both bull and bear markets

All achieved using simple long-only puts and calls, with an average trade size of just $150.

Read the full case study to see our complete trading history and learn how we did it →

Click below to upgrade with a free 30 day trial to Trader’s Edge!

Investor’s Compass Case Studies

“The Investor’s Compass” by DynaLogic uses patented software to track the end-of-day prices of a broad list of equities and ETFs. Our algorithm issues signals whenever a stock or ETF hits a predetermined change in price from the previous execution price. If a security is rising in price, we will issue a sell signal suggesting you take some money off the table. If a security is declining in price, we will issue a buy signal suggesting now may be a good time to add to your position or initiate a position. Additionally, we incorporate The Relative Strength Index (RSI) for each security helping you identify overbought and oversold trends.

This is the basic premise behind our long-term strategic rebalancing offering, which is available to our free subscribers in the form of daily signals alerting you to when we issue buy or sell signals.

See below for some case studies showing the results achieved on specific stocks following our sell and add/initiate signals.

Remember, its not about the past, DynaLogic will be there with you in the future, helping to guide you on when to act whether a stock (or the market) is moving up, down or sideways. But we know that results matter, so we want to highlight some specific examples whether it was protecting gains, mitigating a loss, or recommending a buy at an opportune time.

2023

Tesla (TSLA) - Tesla (TSLA) stock price in 2023 has created a wonderful opportunity to build diversification in a portfolio without giving up any value.

Upstart Holdings (UPST)

Signal Alert- Short Term Trade On August 2nd, our exclusive Sentiment Index highlighted Upstart Holdings (UPST) with a Sell Signal of 3, identifying “Meaningful Downside Risk.” We encouraged our subscribers to trim their positions right before UPST plummeted 50% in a week

Not All Rockets Make It to the Moon - We examine how DynaLogic's signals performed on a stock that appeared to be heading for the moon, but instead came crashing down, ultimately leading to over an 80% increase in total return.

Salesforce (CRM) - We examine how DynaLogic's signals performed on a stock that has risen in price since January 2020.

Costco (COST) - We examine how DynaLogic's signals performed on a stock that has continued to rise in price

Buying When Others are Fearful - At the beginning of 2023, investor sentiment was clearly negative. Six months later, lots of managers had underperformed the markets. What did DynaLogic think?

Boston Beer (SAM) - Explore how DynaLogic’s Signals Turned a Potential Loss Into a 98% Gain.

ARK Innovation (ARKK) - Learn how DynaLogic's sell signals helped investors navigate the ARKK journey and produced a 71% better return vs a buy & hold strategy

Teladoc Health (TDOC) - Mastering the Market: DynaLogic's Sell Signals Turned Teladoc Health's Volatility into 70% Gains

Snapchat (SNAP) - 237% Improvement in Total Return by Following Our Signals on SNAP

Disney (DIS) - Owning Disney Stock over the last few years has been like riding Space Mountain, we explore how following DynaLogic’s system made it less gut-wrenching.

ROKU - For many investors, ROKU hasn't been a positive journey. DynaLogic could have changed all that!

Alibaba (BABA) - Using DynaLogic Led to a 83% improvement in Total Return for Owners of Alibaba Stock Who Followed Our Signals

Nvidia (NVDA) - Here we go again! Our signals produced a 30.6% improvement on buy & hold during NVDA’s rise and fall from March 2020 through October 2022.

DraftKings (DKNG) - We examine how using DynaLogic's signals on DKNG could have improved your total return from 66% to 176% while providing greater diversification and less risk.

2022

Snowflake (SNOW) - Following DynaLogic's sell signals on SNOW would have saved you $20k on a $100k investment versus buying & holding.

Netflix (NFLX) - If you were an opportunistic investor in Netflix, DynaLogic’s “Sell” signals could have helped you pocket a bundle by winding down some of your position, locking in gains.

Ethereum Investment Trust (ETHE) - In other words, following DynaLogic’s Sell signals would have helped you not only earn but actually pocket $96,662 ($151,409 - 54,747 = $96,662) over the past two years on a $100k investment.

Palantir (PLTR) - DynaLogic sent 37 sell signals on Palantir Technologies over a 20 month period, helping subscribers take “risk off” and lock in gains.

PayPal - We look at an example of what would have happened if you acted on the sell signals we sent on PayPal and reinvested the proceeds into the S&P 500 (SPY).

Grayscale Bitcoin Trust (GBTC) - How acting on our sell signals on GBTC and reinvesting in SPY led to a 31% better return than just holding GBTC.

Just Do Something - A Market Low? - We sent 17 strong buy signals on June 17th. If you bought all 17 positions and invested $1000 in each position, and decided to sell them based on the July 29th closing price, your net after-tax gain would be 9.24% for 6 weeks or 74% annualized.

Why You Need to Manage Emotions When Investing - “The Greatest Enemies of Equity Investors are Expenses and Emotions.”

Ready to start managing your emotions and investing better with DynaLogic? Join thousands of other subscribers using our daily buy and sell signals by clicking below.