Smarter Investing Starts Here: How the DynaLogic System Works

Explaining the "Logic" Behind DynaLogic and How to Effectively Use it in Your Investing Strategy

Welcome aboard! At DynaLogic, we believe investing should be based on data—not emotion. That’s why we built our platform around a proprietary, rules-based system that helps you make smarter decisions at critical moments: when stocks are racing higher and the fear of missing out takes over, or when markets are sliding and panic sets in.

As Warren Buffett puts it: “Be fearful when others are greedy, and greedy when others are fearful.” That’s exactly what DynaLogic helps you do—systematically.

Since launch, our platform has powered real results, helping investors rebalance intelligently with Investor’s Compass and seize short-term momentum with Trader’s Edge, which has delivered a portfolio return of ~120% in our first 9 months from July 2024 to April 2025.

What are the DynaLogic offerings??

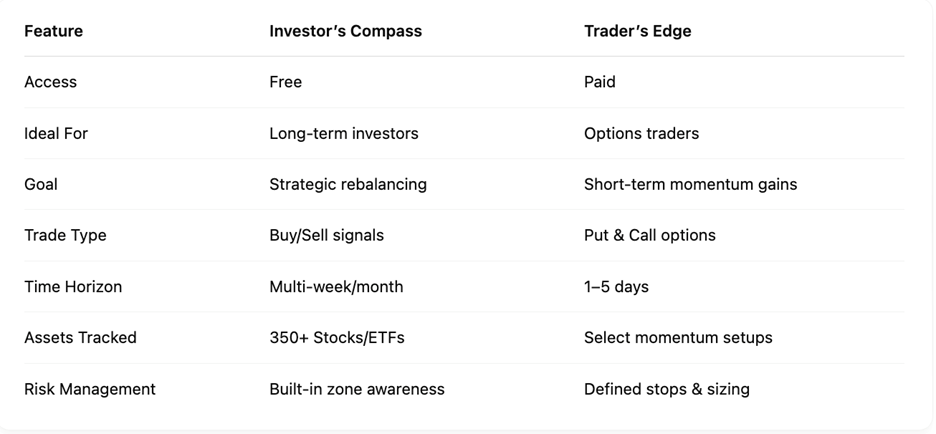

Our platform powers two unique offerings both underpinned by our proprietary DynaLogic system:

• Investor’s Compass – A free daily tool to help you rebalance your long-term holdings using zone-based buy/sell signals.

• Trader’s Edge – A premium service focused on short-term options trades based on momentum and relative strength, backed by real results.

Keep reading to learn more about the Dynalogic system and uncover how each of the two products can help you keep a level head and execute high conviction trades based on proven market signals. We’ve also included a comparison graphic showing what each of our two products offers.

How Dynalogic Works - The Details

The DynaLogic System is built on the premise that markets are volatile. Day-to-day stock prices represent nothing more than buyers and sellers creating supply and demand. As they engage in more buying or selling, prices move up or down, sometimes dramatically.

Even the most sought-after stocks can have intense corrections and even the most sold-off stocks can suddenly rally in price as new buyers recognize the opportunity.

Logic says that the best way to profit from market volatility is to sell when markets are rising and buy when they are falling because NO ONE can accurately predict stock prices for any length of time!

The Dynalogic System is comprised of two main indicators helping us to accurately track trends in both market volatility and price momentum over time. The first indicator is the Relative Strength Indicator, commonly referred to as RSI, and the second is our propriety Dynalogic Zone Technology. Read on to learn more about how we use each of these indicators to help you manage risk and do more buying low and selling high!

Understanding Relative Strength Index (RSI)

Relative Strength Indicator (RSI), developed by J. Welles Wilder, is a popular momentum oscillator that is commonly used in technical analysis to identify overbought or oversold conditions in a financial market. It is a range-bound oscillator, typically oscillating between 0 and 100, and is calculated using the average gains and losses over a 14 day time period.

Overbought and Oversold Levels:

Traditionally, and according to Wilder's original interpretation, an RSI above 70 indicates that a security may be overbought, and an RSI below 30 indicates it may be oversold.

Overbought conditions suggest that the security may be due for a price correction or reversal downward – indicating the presence of downside risk.

Oversold conditions suggest that the security may be due for a price bounce or reversal upward – indicating the presence of upside opportunity.

DynaLogic Zone Technology

We also assign Zones to each tracked security so subscribers can understand where a stock is relative to historical prices when they receive a signal, and the risk or opportunity for that stock.

For instance, a Zone 4 sell signal with an overbought RSI reading above 70 is saying there has been a significant run-up in the price of an underlying security and there is now “Substantial Downside Risk” to price and the security is in an “overbought” position. If you own the security, this might be a good time to “Take some chips off the table”. Think of it as rebalancing a winner, a necessary part of portfolio management.

Conversely, a Zone 1 Add/Initiate signal with an oversold RSI reading below 30 is saying an underlying security has undergone a significant price decline, there may be “Substantial Upside Price Opportunity” which also means limited downside risk. This may be a great time to add to or initiate a position in a stock you have considered owning.

The Investor’s Compass (Available for free to all subscribers!)

The Investor’s Compass is for any investor looking to achieve better investing results by using tools to manage their emotions and protect their gains over an extended period by knowing WHEN to sell stocks or initiate and/or add to positions during market downdrafts. We believe our information is beneficial both to investors managing long-term positions and investors wishing to make short-term trades.

Please note that The Investor’s Compass doesn't tell you WHAT to own. There are plenty of publications out there that focus on this exclusively. Instead, we help you better manage what you own or are considering owning to achieve better outcomes over time.

How to use The Investor’s Compass

The Investor’s Compass uses our patented Dynalogic System to track the end-of-day prices of a broad list of equities and ETFs. Our algorithm issues signals whenever a stock or ETF hits a predetermined change in price from the previous execution price.

If a security is rising in price, we will issue a sell signal suggesting you take some money off the table. If a security is declining in price, we will issue a buy signal suggesting now may be a good time to add to your position or initiate a position. Additionally, we incorporate The Relative Strength Index (RSI) for each security helping you identify overbought and oversold trends.

This offering is available to our free subscribers in the form of daily emails featuring highlighted tickers alerting you to when we issue buy or sell signals in addition to daily access to current data including current zone and RSI reading for our complete inventory of tracked securities (over 350+ and counting). The below screenshot is an excerpt of one of our daily emails giving you a taste of the data you’ll receive each morning as an Investor’s Compass subscriber.

For a full list of the securities we are currently tracking, please see here. We are continuously adding new stocks to the list and are always open to requests from our paid members to add additional stocks from their portfolio. Please reach out to us in the comments or via email with your feedback.

In addition to the data-backed portfolio rebalancing with Investor’s Compass, we recently introduced a premium offering called Trader's Edge, a new tool focused on short-term options trading to help you boost returns in your portfolio.

Trader’s Edge (Available exclusively to Paid subscribers)

Trader's Edge identifies high probability put and call options trades based on specific criteria, such as securities in DynaLogic Zone 1 or with significantly overbought or oversold RSI readings.

Here's an example of a Trader's Edge signal:

On May 29, 2024, Dell Computer (DELL) closed at $179.21 with an RSI of 82.96 (Overbought). Following that close, DELL started trading lower.

On 6/4/24 DELL closed at $135.75 with an RSI of 46.44 and a DynaLogic Zone 1.

Our recommendation would have been to buy a put option to capture the continuing downtrend.

We bought out-of-the-money 8/16/24 with $100 strike price.

On 6/5/24 DELL closed at $137.66 and we added to the put position.

On 6/7/24 we closed out the trade up 36.1%

As with any option position proper risk management must be an integral part of the transaction.

How to use Trader’s Edge:

If you’re ready to learn more about how to leverage Trader’s Edge to help boost returns in your portfolio, we recommend checking out the below article which dives deeper into options trading with DynaLogic and Trader’s Edge.

Trader's Edge: Enhance Your Investment Strategy with Options Trading

Additional Resources

We have a ton of case studies showcasing the great results we’ve seen using our DynaLogic System (and hundreds more we just haven’t yet written out).

See the articles below to discover more about the DynaLogic System, including Trader’s Edge, and how to use it most effectively as part of your investment strategy.

Accessing Investor’s Compass and Trader's Edge

Following DynaLogic helps you to minimize risk while still having the greater upside opportunity of investing in individual securities. We’re confident that using our platform will lead to better investing results in your portfolio over the long run, and our subscribers regularly write to us with their success stories.

Free subscribers will receive daily Investor’s Compass signals focused on long-term strategic portfolio management and rebalancing as well as additional data on all securities, including current zones and RSI readings

Paid subscribers will have access to Trader's Edge signals identifying high conviction short term options trades

Ready to start managing your emotions and investing better with DynaLogic? Join thousands of other subscribers using our daily buy and sell signals and options trades by clicking below.

For full access to our signals and Trader’s Edge, upgrade your subscription today and let the complete DynaLogic platform help you manage your emotions and improve your investing outcomes.

Subscribedutcomes.

We thank you for subscribing. Please SHARE “The Investor’s Compass” with a friend.

(Note: DynaLogic provides to subscribers relevant and real time market movement information on a host of equity securities. Signals (sell or buy) are based solely on mathematical changes in the price of a security. No other methodology is used.

DynaLogic is not a registered investment advisor, and it makes no representation or recommendation concerning the purchase or sale of any security investment product; DynaLogic provides no advice or recommendation whether a subscriber should or should not act on any signal a subscriber receives, and it has no knowledge whether a subscriber, in fact, acts on a signal or any signal; DynaLogic maintains no portfolio account or other investment information on any subscriber.)

Thanks Jamie for weighing in. Hope DynaLogic continues to carry you on a successful investment journey.

I've been using DynaLogic for 6 months now. I've already seen a big impact and it's provided me a roadmap for sound decision making. The best part... I am not one that is trying to make the decisions. I've spent far too many years guessing what to do with my investments based on what feels right. This lays it all out in a simple way and tells me when and how to make decisions.